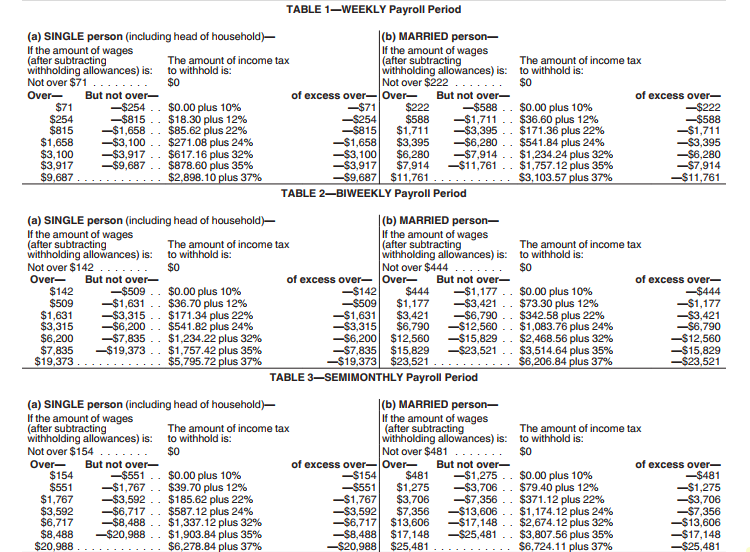

Irs Monthly Withholding Tables 2025. The 2025 tables for federal income tax withholding are now available, irs said during a recent payroll industry call. See section 7 for the withholding rates. The local tax rates for taxable year 2025 are as follows:

See current federal tax brackets and rates based on your income and filing status. Single taxpayers 2025 official tax.

For taxpayers with filing statuses of married filing jointly, head of household, or qualified surviving.

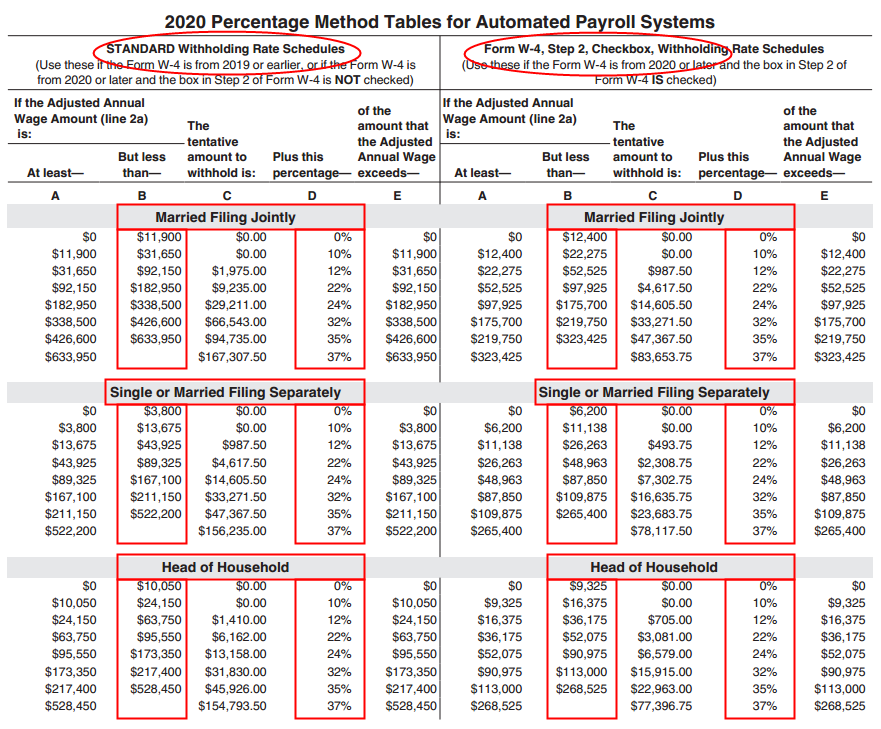

2025 Tax Brackets Irs Chart Sukey Engracia, Find tax withholding information for employees, employers and foreign persons. The legislated stage 3 income tax cuts are not due to commence until 1.

T130159 Baseline Distribution of and Federal Taxes; by, Here’s what you need to know for the 2025 withholding tax tables: The department has updated its wage withholding tax tables ( employer and information agent guide) as well as the employee’s withholding and exemption.

Understanding The State Of Withholding Tax Tables In 2025 Scott Trend, See current federal tax brackets and rates based on your income and filing status. Payments subject to kansas withholding.

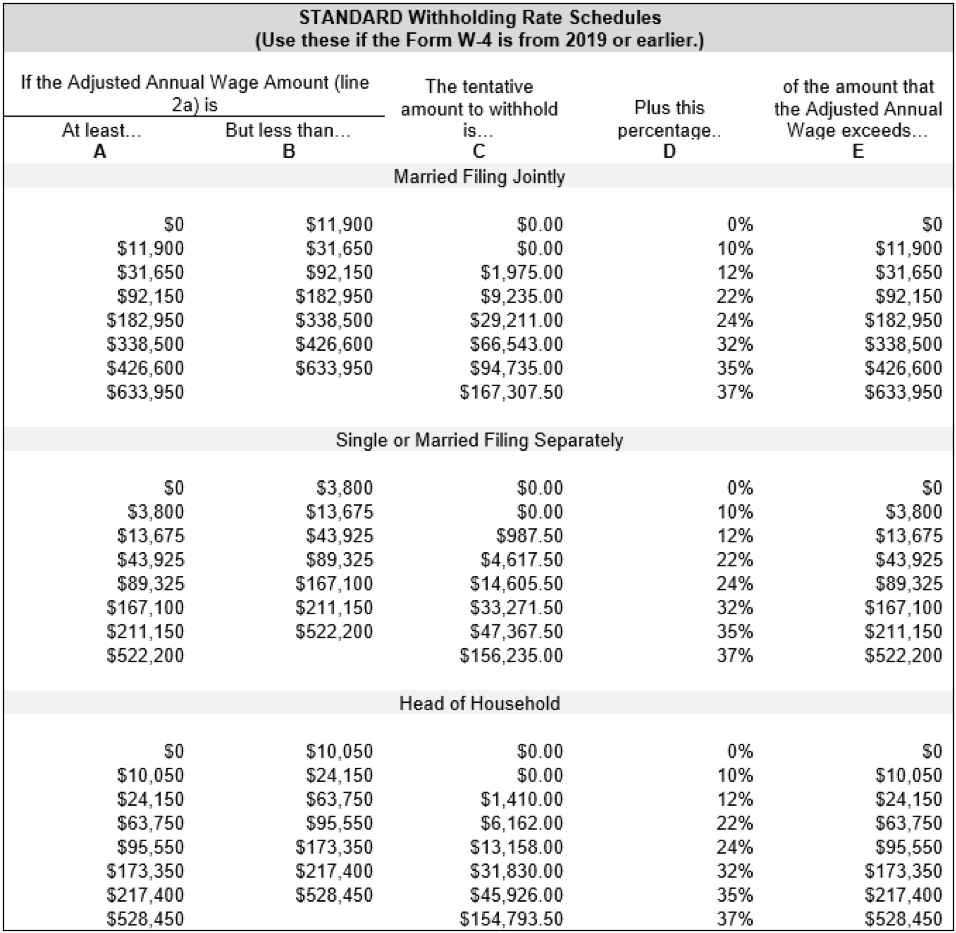

IRS Tax Tables Federal Withholding Tables 2025, The legislated stage 3 income tax cuts are not due to commence until 1. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

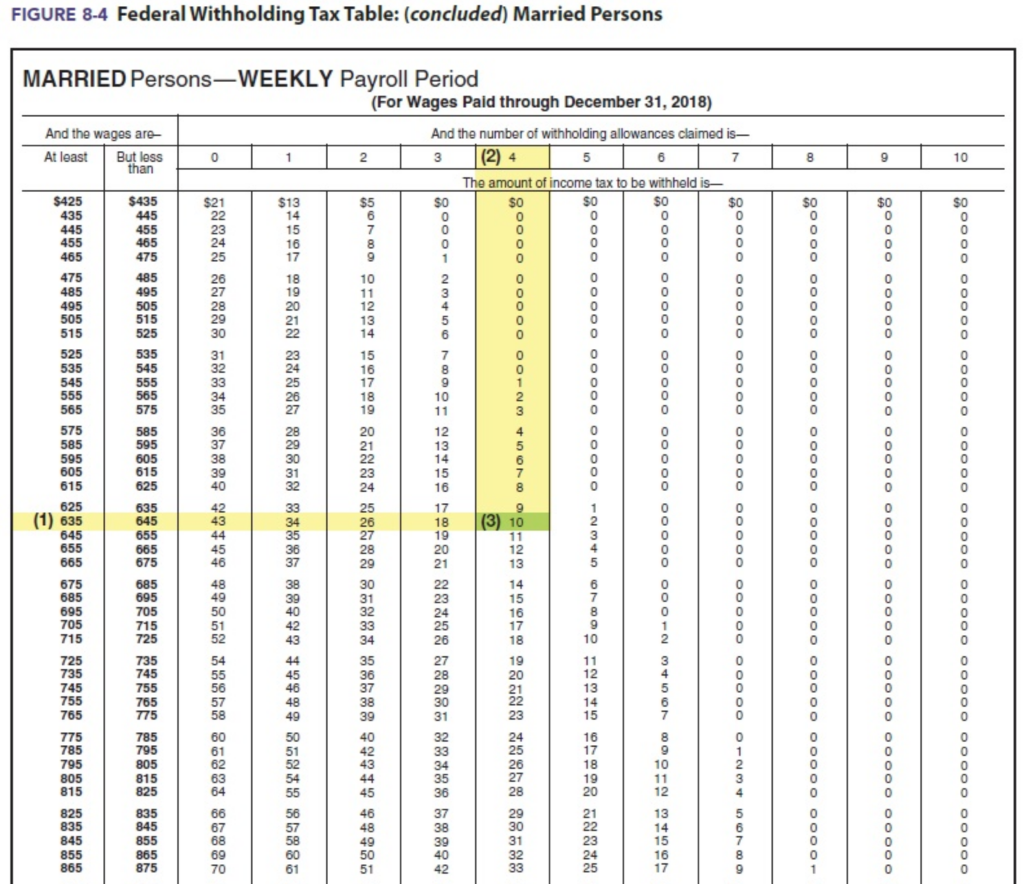

Employer's Federal Withholding Tax Tables Monthly Chart Federal, Single taxpayers 2025 official tax. Employer federal income tax withholding tables 2025 is out now.

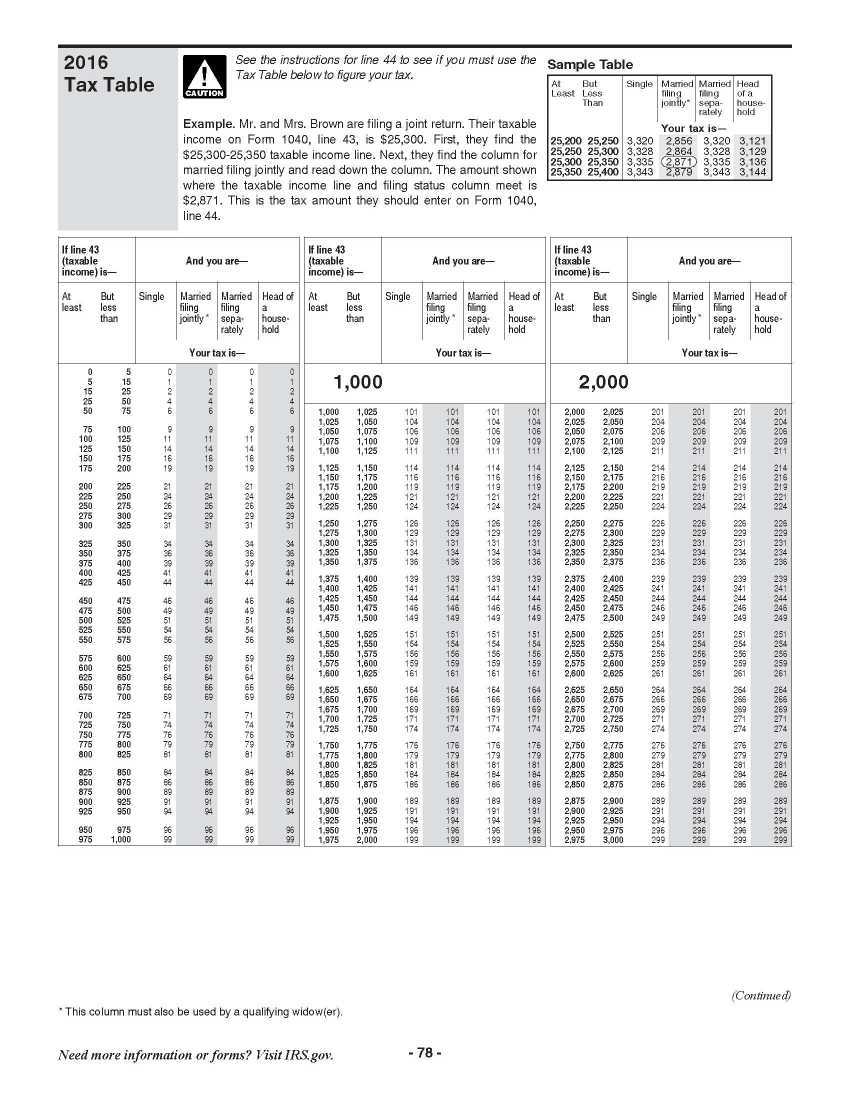

IRS EZ Tax Table 2025 2025 EduVark, Estimate your federal income tax withholding; For married couples filing jointly,.

Listed here are the federal tax brackets for 2025 vs. 2025 FinaPress, The service posted the draft version of. See section 7 for the withholding rates.

Married Federal Tax Withholding Table Federal Withholding Tables 2025, The 2025 tables for federal income tax withholding are now available, irs said during a recent payroll industry call. The standard deduction for a single person will go up from $13,850 in 2025 to $14,600 in 2025, an increase of 5.4%.

Irs 2025 tax tables bingerbarcode, For taxpayers with filing statuses of married filing jointly, head of household, or qualified surviving. See 2025 tax brackets see 2025 tax brackets.

IRS Weekly Withholding Tax Table Federal Withholding Tables 2025, On a yearly basis, the internal revenue service (irs) adjusts more than 60. The standard deduction for a single person will go up from $13,850 in 2025 to $14,600 in 2025, an increase of 5.4%.